Is Your Retirement In Shape?

These six, tried-and-true methods, will boost your investment results and help you build a better portfolio.

— Read on www.investopedia.com/articles/stocks/11/6-ways-improve-portfolio-returns.asp

Lt. Kaffee told Corporal Dawson at the end of A Few Good Men, “you don’t need to wear a patch on your arm to have honor”. Although this quote is from a fictional movie, I believe the message to be true in the retirement planning space as well. In the financial advising world, the patch is a license, or a designation, or a title. And honor, is doing the right thing. Being honest and transparent with your client, staying knowledgeable in your field, communicating appropriately and producing results, are all part of doing the right thing. Regardless of what patch you wear.

The key for consumers is choosing someone you like and trust, someone you find knowledgeable in the field, someone who is transparent and honest, someone who is out for your best interest, and someone who will answer your call (or be very responsive if not).

If you don’t value financial advice, or if you distrust financial advisors and registered reps, or if you don’t believe in paying fee’s or commissions for services, there are multiple ways to do it yourself. Be careful of the “experts” telling you someone must have a designation, or must be a fee-based planner, or must be this or that, it may be that they just “can’t handle the truth”. Some registered reps actually do the right thing, they provide on-going service, they produce results, and you will enjoy working with them.

Bottom line is do your research, ask for references, talk to your colleagues, and meet with the financial professional in person (or on zoom). If they have strong references, you find their cost competitive, they are genuine, knowledgeable and truly out for your best interest, then hire them to work your account. If not, then move on.

Thanks for reading and Happy Saving!

WorkLife, powered by yours truly, is my introduction into holistic retirement planning. What do I mean by holistic? How important will my financial advice be if my clients are too unhealthy or too severely depressed to enjoy life? WorkLife addresses physical well-being, mental well-being, and financial well-being.

Check it out:

https://jsc403b.loyalty.life/#/signup/SmltIENhdmFuYXVnaFNvY2lhbCBNZWRpYSBMZWFkc05ldyBZb3Jr

It’s perplexing why school district personnel decided distributing retirement programs in the faculty break room was a good idea. These poor teachers get approximately 40 minutes to themselves. Maybe they enjoy adult time with colleagues, or quiet time away from excited children, or simply sitting down to collect their thoughts. The last thing they want to do? Fight for air space with financial sales professionals, armed with the latest engagement tactics. Disruptive marketing 101. It’s time to change the current 403(b) distribution process for K-12 employees, because the existing process is disruptive, unappreciated and fails to provide the environment necessary for successful retirement planning. #403(b) #403(b)(7)

No excuses this year, plenty of time to work on the swing.

There are obvious differences between amateur golfers and professional golfers’ swings. Here they are, and how to avoid them.

— Read on www.golf.com/instruction/columns-instruction/2020/02/10/amateur-golf-swing-mistakes-pros/

A message for my 403(b) clients,

A timely and sensible article during difficult unpredictable financial times.

In terms of the stock market and your retirement accounts, the last few weeks have been the most volatile time in recent years. Gains and losses not only happen more frequently, they are far more extreme than we have grown accustomed to lately. The markets are like swinging pendulums, posting 1000 point losses, followed by 800 point gains, this has become an almost every other day occurrence. It’s common to wonder what should I do?

For answers to that question, I reference a recent article from financial website, Marketwatch (see website link below).

For the long-term investor, have little fear, periodic purchasing into internationally diversified equity, which you all currently do, increases your chances of earning a positive return.

Another point I liked was:

“A falling stock market can be a gift for young investors, but only if they take advantage by deploying their savings at lower prices.”

Ben Carlson is the author (@awealthofcs is his twitter handle)

Marketwatch; Outside the box, “Should young investors keep 100% of their money in stocks during a correction?”, Ben Carlson https://www.marketwatch.com/story/should-young-investors-keep-100-of-their-money-in-stocks-during-a-correction-2020-03-09?mod=home-page

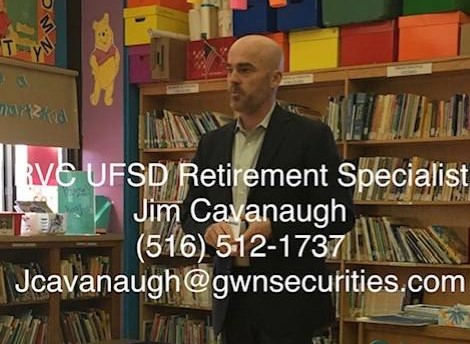

Riveting presentation providing awareness to NEA Member Benefits, Discounts and Retirement Program. Love STELLAR Rooms and Smart Boards!!!!

How many teachers go through their career promising themselves they will have their 403(b) reviewed for performance and cost? My guess is a lot. The reality is, objective reviews do exist and they take approximately 30 to 45 minutes. This minimal investment in time will provide reassurance in your current plan. Set up a virtual appointment through the link below.